McKinsey Global Institute has estimated AI-based pricing and promotion optimization in retail to have the potential to deliver over $250B in global market value.

Numbers are staggeringly high.

So high in fact that it's difficult to comprehend the potential impact to an individual business.

Let's take a European DIY retailer as an example. Leveraging campaign pricing optimization the retailer drove 14.2% sales growth.

For a chain of tens of stores that translates to a chunk of euros in a single fiscal year.

And if that wasn't enough, the same DIY retailer continued to adopt pricing optimization to its base assortment generating a whopping 23.9% margin increase.

Without getting into actual monetary value (surely you wouldn't like your revenue numbers to be published either) pricing optimization helped to increase the retailer's top-line revenue as well as gross margin.

Why is pricing difficult nowadays?

A global survey conducted by Bain & Company found that 85% of management teams believe their pricing decisions need improvement".

"85% of management teams believe their pricing decisions need improvement".

But what makes pricing so complicated nowadays?

In brief – customers and competitors.

Consumer behavior is fragmented and it varies over time and place. The optimal product-price combination for one is not optimal for another.

What’s more, the product range has exploded and the frequency of new launches has accelerated. That’s lead to more intensive competition.

When everything’s transparent, thanks to the internet, there’s a lot to consider when setting the prices.

How demand-driven pricing optimization guides you to address local demand and tackle competition

A discount retailer with some 150 stores wanted to improve its price-setting process. They assumed that they are selling certain products at too low prices whereas some others might be too expensive compared to the competition.

With price optimization, the retailer gained an understanding of individual products’ price elasticities as well as competitor pricing.

As a result, they could see which products had to be sold with reduced prices and which products’ pricing could be increased – despite the competitors’ actions.

Without getting nitty-gritty about how pricing optimization tool works, the process includes two important steps.

1 - price elasticity analysis

2 - pricing optimization

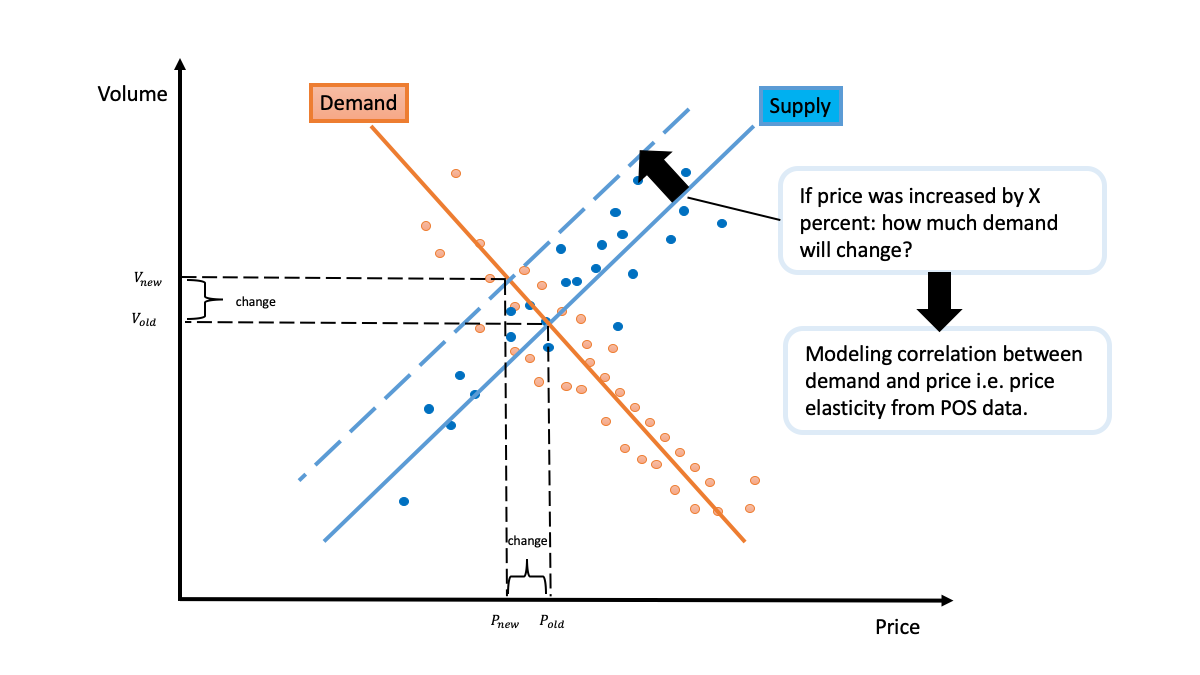

Price elasticity tells how sales of a product change as the price changes.

When you know which of your products (or services, for that matter) have elastic prices, you already have enough data to make decisions about which products you can use for price campaigns.

Exactly, discounting them will attract customers and drive more sales.

And, in contrast, when you know which products have non-elastic prices, you know that it doesn't make any difference to sales discounting them. In fact, discounts will only diminish your margins.

How to exploit pricing optimization as a new business lever

Pharmacies operate in an environment where 2/3 of the business is regulated.

Assortment width plays a crucial role for customer satisfaction along with customer service but the levers to grow revenue and gross margins are traditionally limited.

Visionary pharmacy wanted to change the industry rules and introduce pricing optimization as a new business lever.

Applying pricing optimization to over-the-counter products, they identified elastic SKUs for campaign products and, by determining the right level of discounts developed campaign sales profitably.

Conversely, the non-elastic SKUs were used as base assortment where pricing potential was based on the profit increase based on the price increase.

Revenue and gross margin development were based on non-elastic over-the-counter SKUs base assortment price increase and elastic over-the-counter SKUs campaign pricing, generating an 8.6% revenue increase and 3.6%-unit gross margin increase in the short term.

The amount of data and variables related to pricing optimization is too much for human intelligence to comprehend - AI is needed to do the heavy lifting

The price elasticity is effectively a function of the quantity expected to be sold, given the price set. Let us represent it by q(p). Then, our objective is to maximize the total revenue, which would be the price p times the quantity q(p).

In addition to the price also other external factors such as competitors, their pricing and promotions, weather, holidays, or other campaigns have an impact on the price elasticity model.

This is itself an initial challenge since it poses a nonlinear relationship that can be tricky to handle without appropriate tools (as a side note, most optimization technology available is more robustly efficient when models are expressed by linear expressions only).

But the real challenge comes from the consideration of multiple products simultaneously. On top of trying to set the prices on their sweet spot in terms of maximizing revenue, we also have to take into account pricing rules among products within the same family or among different families.

These rules arise, for example, taking into account pricing guidelines considering competitors, or making sure that prices of different varieties of the same product are consistent.

This is challenging in that the combination between possibilities for price points for all products can be too large to be handled.

To tackle that, mathematical programming is employed which is closely related to optimization and allows us not only to implicitly represent all possible prices that satisfy pricing rules but also to find which of such prices maximise the revenue.

Maintaining the competitive advantage in pricing optimization

One-off pricing optimization has proved to deliver a fast time-to-value. However, the effects will dilute over time, due to market changes and competitors' pricing actions.

Sustaining the advantage requires the same systematic approach as any part of the business - a process.

Automating pricing optimization with a SaaS solution will help you to make smart easy. It automatically keeps track of competitors and pinpoints the individual SKUs or categories that require pricing actions.

How to get started with pricing optimization

Typically the journey to employ pricing optimization is straightforward.

To meet each organization’s specific needs, Houston Analytics has developed a simple approach to pricing optimization:

Proof of concept

After a one-time data transfer and alignment of business goals, pricing rules and guidelines an initial price elasticity analysis and pricing optimization will be done. t

These results will already identify quick wins potential and can be used as initial business case calculation.

Proof of concept is typically performed in select locations or categories in eCommerce for one to two months during which the results will be validated.

Automation and SaaS rollout

The final stage makes sure the impact is lasting. Automation will be finalized and the client gets full access to the SaaS.

Onboarded client team with their honed process will ensure the changes last.

Moreover, in most cases, the return on investment is less than six months after full automation.

What do you think the financial impact would be in monetary terms in your case?